The FCA define a vulnerable customer as someone who may be susceptible to harm as a result of poor health, life events, low resilience, or low capability. These characteristics of vulnerability may be present individually or in combination.

| 24.9m (47%) of UK adults display one or more characteristics of vulnerability | |

|---|---|

| POOR HEALTH | 7% |

| LIFE EVENTS | 20% |

| LOW RESILIENCE | 24% |

| LOW CAPABILITY | 19% |

Poor health might result in rising health care costs or a reduced ability to work and earn money. Poor health also includes mental health which can impair decision making.

Life events might include bereavement, separation, loss of job or gaining responsibility for caring for others. These can all put people in a more difficult position.

Low resilience typically includes those with limited financial reserves, who are already in financial difficulty or who could easily find themselves unable to meet their outgoings in event of a financial shock.

Low capability includes those who may have difficulty in understanding or accessing products and services. This may be due to financial awareness, cognition, impairment of senses, language barriers and ability to engage through technology.

Due to these characteristics vulnerable consumers may be less able to represent their best interests. They may also be more prone to behavioural biases that negatively affect their decision making. And with 76% not even recognising they are vulnerable the onus is on firms to spot signs and treat customers accordingly.

We at Cutronas Financial Services also need to stay alert to our customers changing circumstances, anyone can be impacted by vulnerability at any time.

Awareness and Culture at Cutronas

Staff awareness and capability is critical to identifying customer vulnerability and providing ongoing support to vulnerable customers.

It is of equal importance in embedding the right culture, so employees are alert and motivated to act.

We endeavour to develop pen portraits (for vulnerable customers) which can help with product and service design. Analysing customer data also helps us to assist in identifying vulnerability. Through conversation with clients and through timely reviews of client needs, to ascertain any change over time.

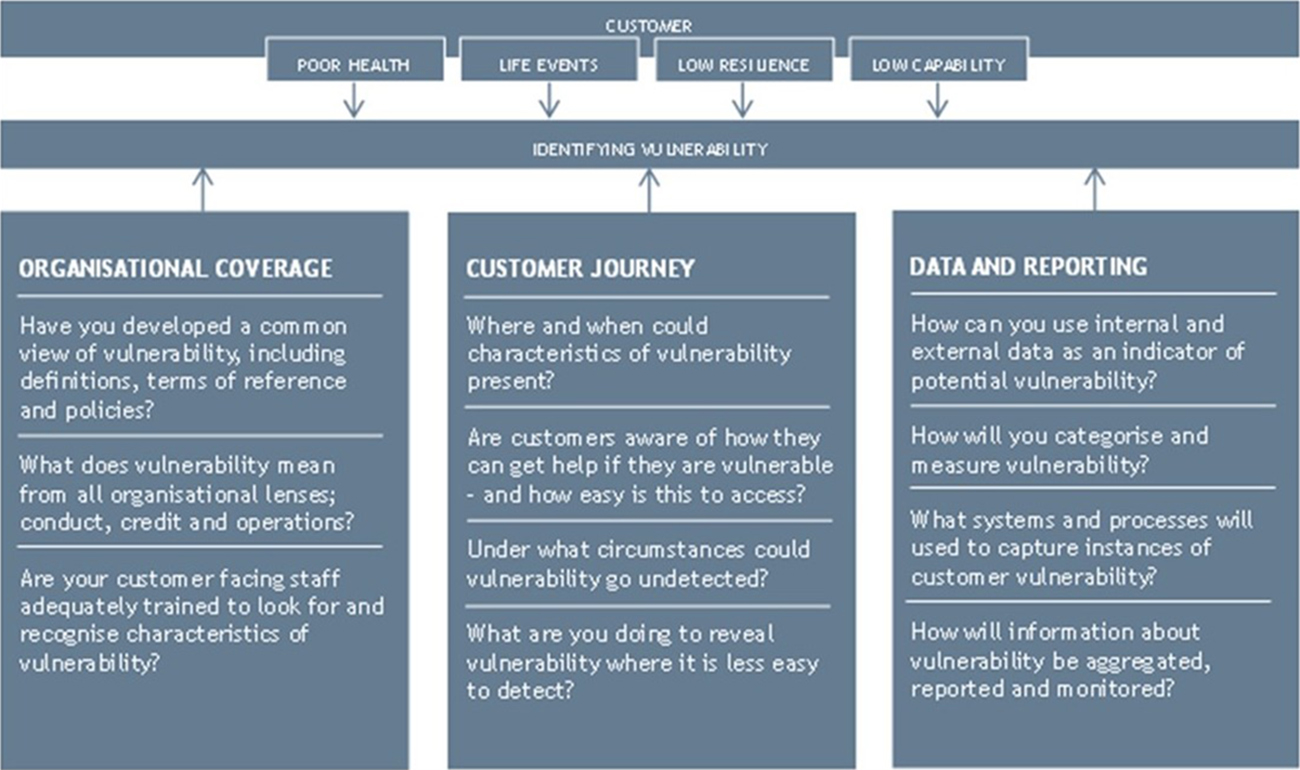

Identifying Vulnerability

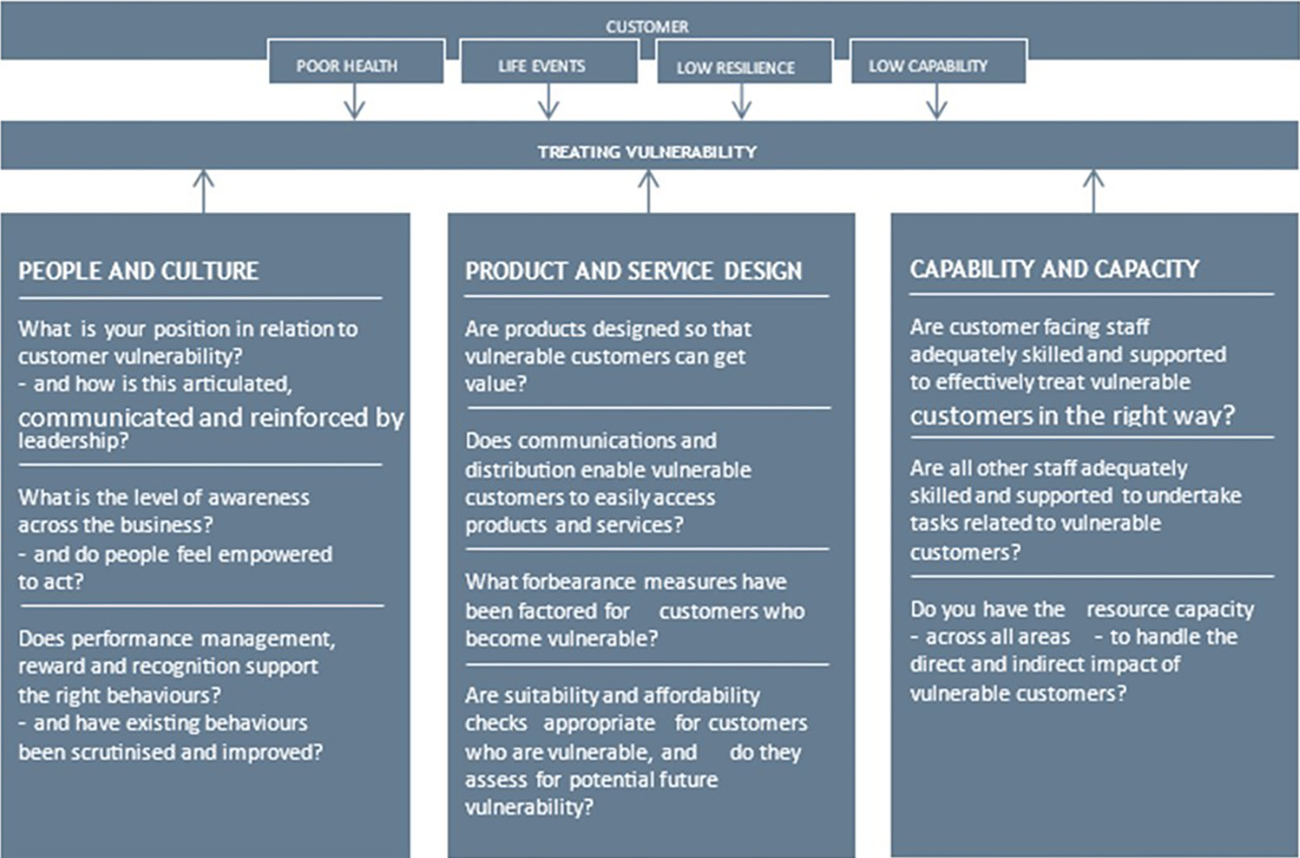

Dealing with Vulnerability / Treating People Fairly

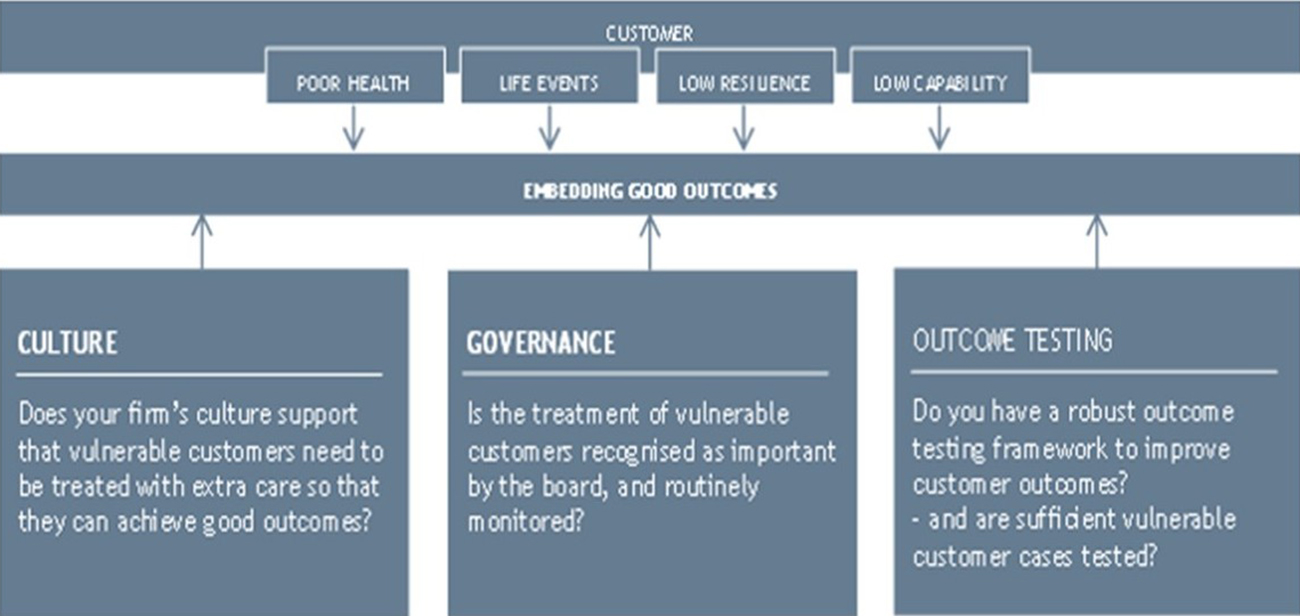

Creating Good Outcomes